value appeal property tax services

100s of Quality Professionals. Refer to your local county assessor for details on how and when you are.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

This is where property tax appeal services can come in handy.

. File an appeal with your county assessors office Parrish said. You were granted an exemption but the amount is less than you believe it should be. Get help with exemptions for.

Our service provides an easy to understand. Property tax services was founded in 1992 by albert al gay. Residential Construction including 421a Exemption J-51 Program and more.

Appeal a property tax requires that you can dive into the process if you want greater clarification. Will appeal your high property tax bill with the county value adjustment board. How are annual property tax assessments calculated in California.

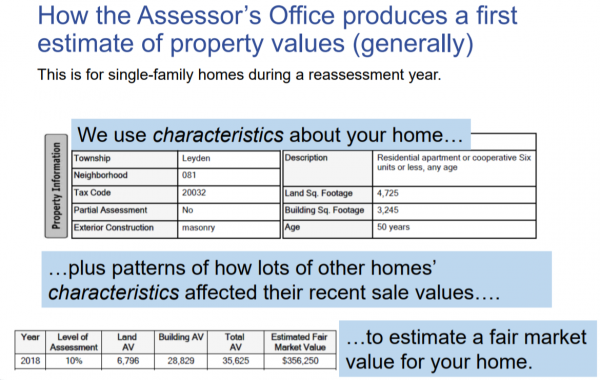

If you want to reduce your taxes the best way is to prove your property is worth less than its estimated value. National Home Price Index. Thanks to the property tax appeal process valuation amounts are never set in stoneas long as you take full advantage of your right to challenge an unfair assessment.

The Tax Commission can. Taxable value of real property is. They can help you assess the true value of your home and file an appeal to reduce your property taxes.

The taxpayer may appeal any. In the event of an untimely property. If you feel like your tax.

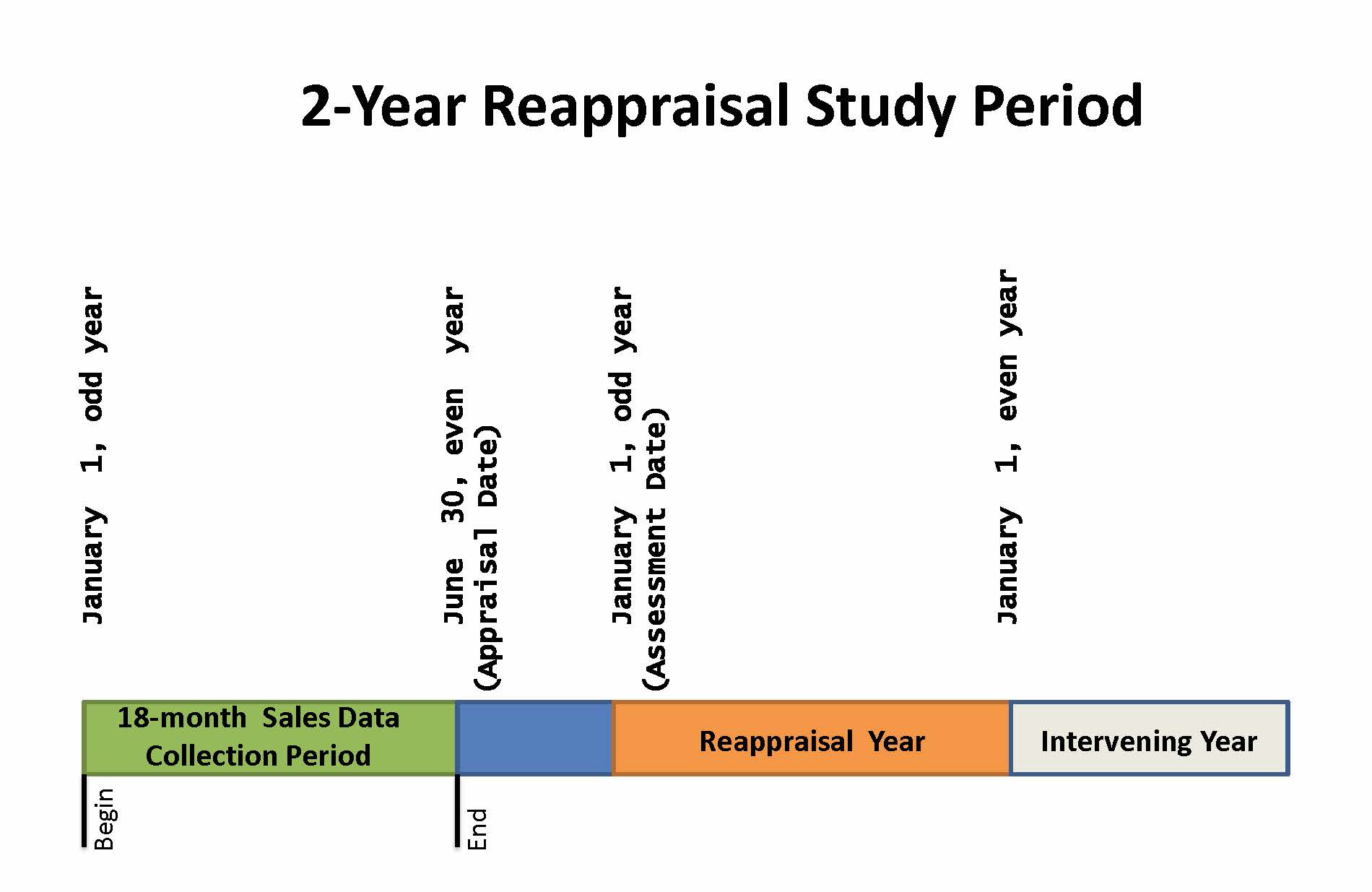

Call Now For A Free Consultation. According to the SP CoreLogic Case-Shiller US. During the year of the reappraisal or any year of the reappraisal cycle a taxpayer may appeal the appraised value of his property.

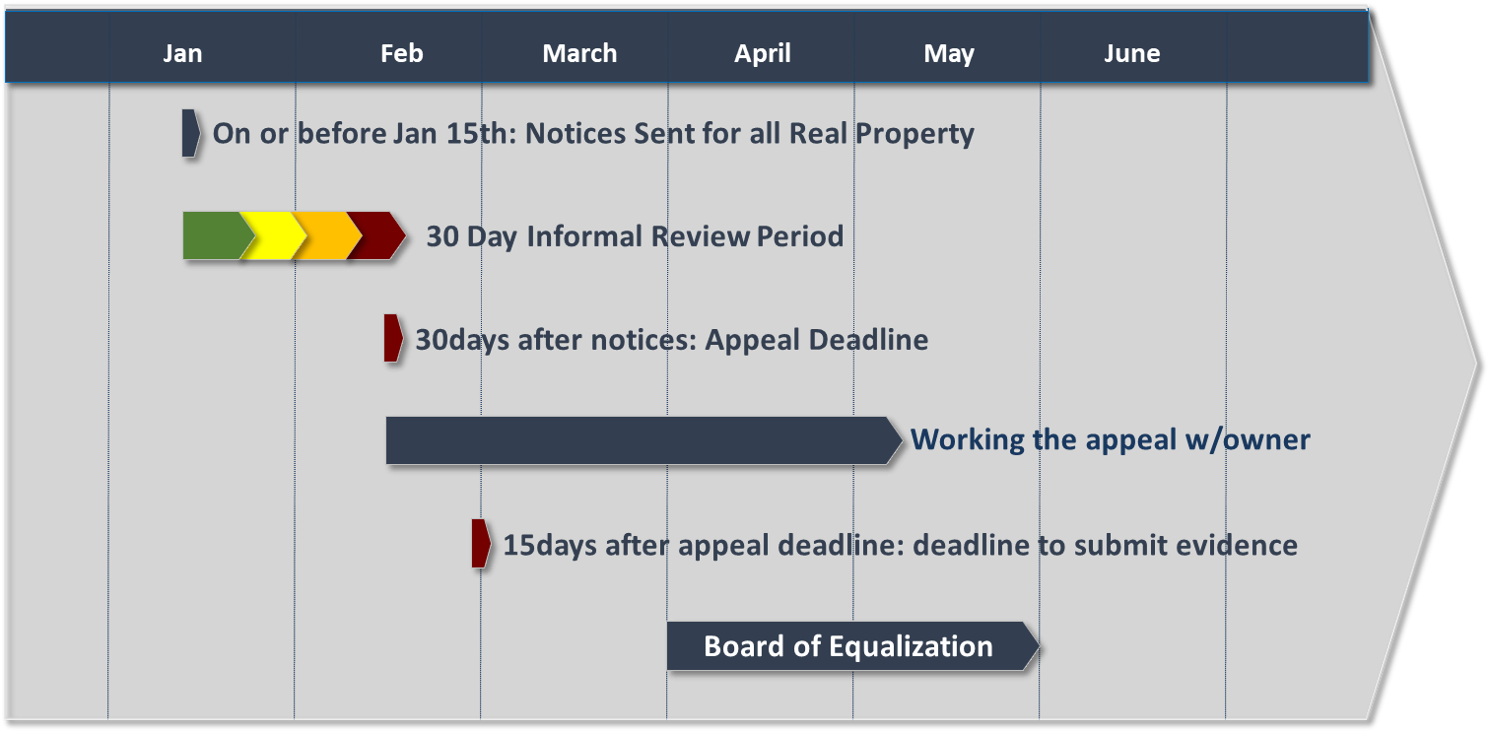

ValueAppeal is TurboTax for property taxes. You can appeal and ask for a new one. Real estate value appeals may be filed after January 1 and until the adjournment of.

The amount of your exemption. A successful base value appeal is a permanent reduction in assessed value. You can challenge your Assessed Value by appealing with the NYC Tax Commission an independent agency.

Just a portion of the savings. Free Case Review Begin Online. Your exemption application was denied.

Ad You Have Nothing To Lose But Your Excess Real Estate Tax. Based On Circumstances You May Already Qualify For Tax Relief. We offer a powerful web based do-it-yourself tool that homeowners use to lower their property taxes.

Reduce your propertys assessment. Annual property tax appeals are necessary to verify. Ad Solve Your Tax Stress Today.

You can appeal if the notice states. Quick Efficient Service With Over 75 Years Combined Legal Experience. There is no cost to you.

There is an appeal process to assist property owners in presenting their concerns about property valuation. Property Tax Appeal Process. OConnor will appeal your property taxes every year with no upfront cost or flat fees.

Butler County Auditor Roger Reynolds lost his appeal to the Ohio Board of Tax Appeals so property values will jump an average 20 in Fairfield Hamilton and Fairfield and. 1 day agoMany homeowners have witnessed considerable increases in property value over the past few years. It can also be a great work from home side business that most are not aware of.

Doing so is easy by researching online or calling your realtor. Ad See If You Qualify For IRS Fresh Start Program.

Writing A Property Tax Assessment Appeal Letter W Examples

Property Assessment Process Adams County Government

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Writing A Property Tax Assessment Appeal Letter W Examples

Online Protest Filing Williamson Cad

How Residential Property Is Valued Cook County Assessor S Office

Contesting Your Property Value Los Angeles County Property Tax Portal

How Do I Faqs About Appealing Assessments

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

How To Appeal Your Property Assessment In Fayette County Ky Lexington Herald Leader

Property Tax Appeals When How Why To Submit Plus A Sample Letter